All Categories

Featured

Table of Contents

- – How do I apply for Iul Interest Crediting?

- – Iul Retirement Planning

- – Can I get Iul Companies online?

- – What types of Iul Growth Strategy are available?

- – How do I cancel Indexed Universal Life Accou...

- – What is the difference between Indexed Unive...

- – What should I look for in a Indexed Universa...

In the event of a gap, exceptional policy lendings in excess of unrecovered cost basis will undergo ordinary income tax. If a plan is a modified endowment contract (MEC), plan car loans and withdrawals will be taxed as regular income to the extent there are earnings in the plan.

It's crucial to note that with an external index, your plan does not straight take part in any type of equity or fixed earnings financial investments you are not getting shares in an index. The indexes offered within the plan are built to keep track of varied sectors of the United state

How do I apply for Iul Interest Crediting?

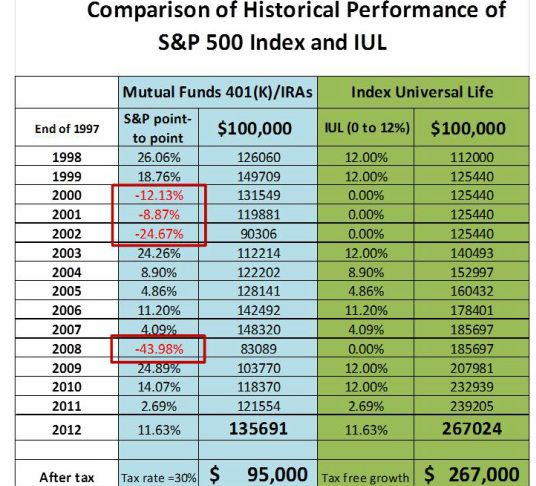

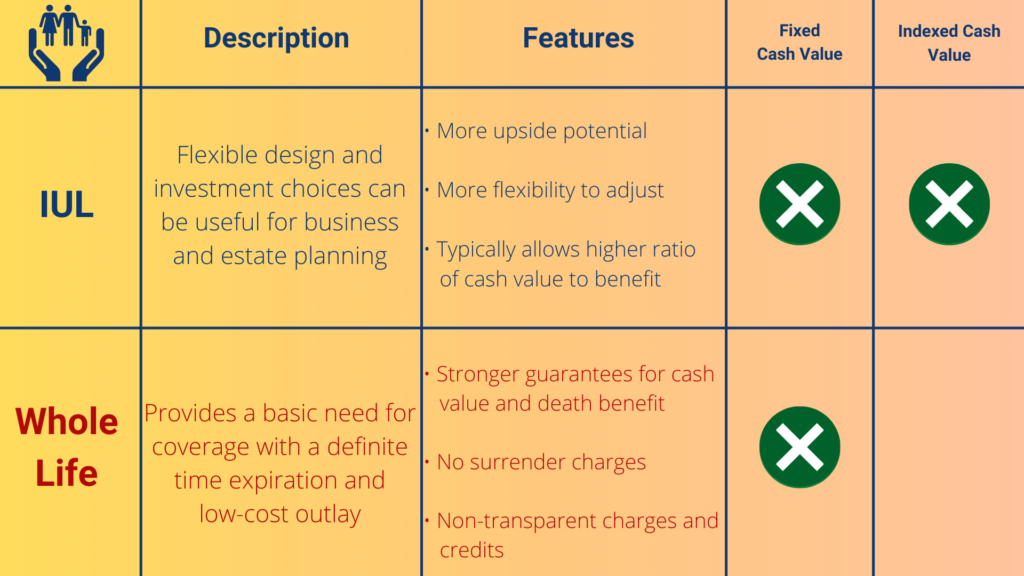

An index may impact your rate of interest attributed, you can not purchase, directly take part in or obtain dividend settlements from any of them via the plan Although an exterior market index might affect your passion attributed, your policy does not directly take part in any kind of stock or equity or bond investments. IUL vs whole life.

This web content does not apply in the state of New york city. Guarantees are backed by the economic strength and claims-paying capacity of Allianz Life insurance policy Business of North America. Products are issued by Allianz Life Insurance Policy Business of The United States And Canada, 5701 Golden Hills Drive, Minneapolis, MN 55416-1297. .

Shield your enjoyed ones and save for retirement at the exact same time with Indexed Universal Life Insurance Policy. (IUL investment)

Iul Retirement Planning

HNW index universal life insurance can help accumulate money worth on a tax-deferred basis, which can be accessed throughout retirement to supplement revenue. (17%): Insurance holders can typically borrow versus the cash money worth of their policy. This can be a resource of funds for different demands, such as spending in an organization or covering unanticipated expenses.

The fatality advantage can assist cover the costs of searching for and training a replacement. (12%): In many cases, the money worth and survivor benefit of these policies may be protected from lenders. This can offer an extra layer of economic security. Life insurance coverage can likewise assist reduce the risk of an investment profile.

Can I get Iul Companies online?

(11%): These policies provide the possible to gain rate of interest connected to the efficiency of a securities market index, while also giving a guaranteed minimum return (IUL for retirement income). This can be an attractive choice for those looking for growth capacity with downside defense. Resources permanently Research 30th September 2024 IUL Study 271 respondents over one month Indexed Universal Life insurance policy (IUL) might appear intricate initially, however recognizing its technicians is essential to understanding its complete potential for your economic planning

If the index gains 11% and your participation rate is 100%, your money worth would certainly be credited with 11% passion. It is very important to note that the optimum interest attributed in a provided year is topped. Let's say your selected index for your IUL plan acquired 6% from the start of June to the end of June.

The resulting rate of interest is added to the cash money value. Some plans calculate the index obtains as the amount of the changes through, while other plans take approximately the daily gains for a month. No rate of interest is credited to the cash money account if the index goes down instead of up.

What types of Iul Growth Strategy are available?

The price is established by the insurance business and can be anywhere from 25% to even more than 100%. IUL policies usually have a flooring, frequently set at 0%, which safeguards your cash money worth from losses if the market index carries out adversely.

The rate of interest attributed to your cash money value is based on the performance of the picked market index. The part of the index's return attributed to your cash money worth is determined by the participation rate, which can differ and be changed by the insurance policy company.

Shop about and compare quotes from different insurance policy firms to discover the finest plan for your needs. Before picking this type of plan, ensure you're comfortable with the potential fluctuations in your cash worth.

How do I cancel Indexed Universal Life Account Value?

Comparative, IUL's market-linked money value development supplies the potential for higher returns, especially in beneficial market problems. This potential comes with the danger that the stock market performance may not supply regularly secure returns. IUL's flexible costs payments and adjustable death benefits supply flexibility, attracting those looking for a plan that can develop with their transforming financial circumstances.

Indexed Universal Life Insurance Policy (IUL) and Term Life insurance policy are different life policies. Term Life Insurance covers a details duration, usually between 5 and 50 years. It only gives a survivor benefit if the life guaranteed dies within that time. A term policy has no cash value, so it can not be made use of to provide life time benefits.

It is appropriate for those looking for short-lived security to cover certain monetary responsibilities like a home funding or youngsters's education costs or for business cover like investor defense. Indexed Universal Life (IUL), on the various other hand, is a long-term life insurance policy policy that provides insurance coverage for your entire life. It is more pricey than a Term Life plan since it is created to last all your life and provide an ensured money payout on fatality.

What is the difference between Indexed Universal Life For Wealth Building and other options?

Picking the ideal Indexed Universal Life (IUL) plan has to do with discovering one that aligns with your financial objectives and run the risk of tolerance. An experienced economic consultant can be invaluable in this procedure, directing you through the complexities and ensuring your selected plan is the best suitable for you. As you investigate purchasing an IUL policy, maintain these crucial factors to consider in mind: Understand exactly how attributed rate of interest are connected to market index efficiency.

As described earlier, IUL policies have various fees. Understand these prices. This figures out just how much of the index's gains add to your money worth development. A higher rate can boost potential, however when contrasting policies, assess the money value column, which will assist you see whether a greater cap price is much better.

What should I look for in a Indexed Universal Life Death Benefit plan?

Various insurance companies offer variants of IUL. The indices tied to your plan will straight impact its efficiency. Versatility is important, and your plan must adjust.

Table of Contents

- – How do I apply for Iul Interest Crediting?

- – Iul Retirement Planning

- – Can I get Iul Companies online?

- – What types of Iul Growth Strategy are available?

- – How do I cancel Indexed Universal Life Accou...

- – What is the difference between Indexed Unive...

- – What should I look for in a Indexed Universa...

Latest Posts

Equity Indexed Universal Life Policy

Universal Life Form

Index Life Insurance Companies

More

Latest Posts

Equity Indexed Universal Life Policy

Universal Life Form

Index Life Insurance Companies